This tab offers four parts: Summary, Attribution, Risk-Return and Correlation.

After you select your target

portfolio/model portfolio, you can assess the risk in your selected portfolio.

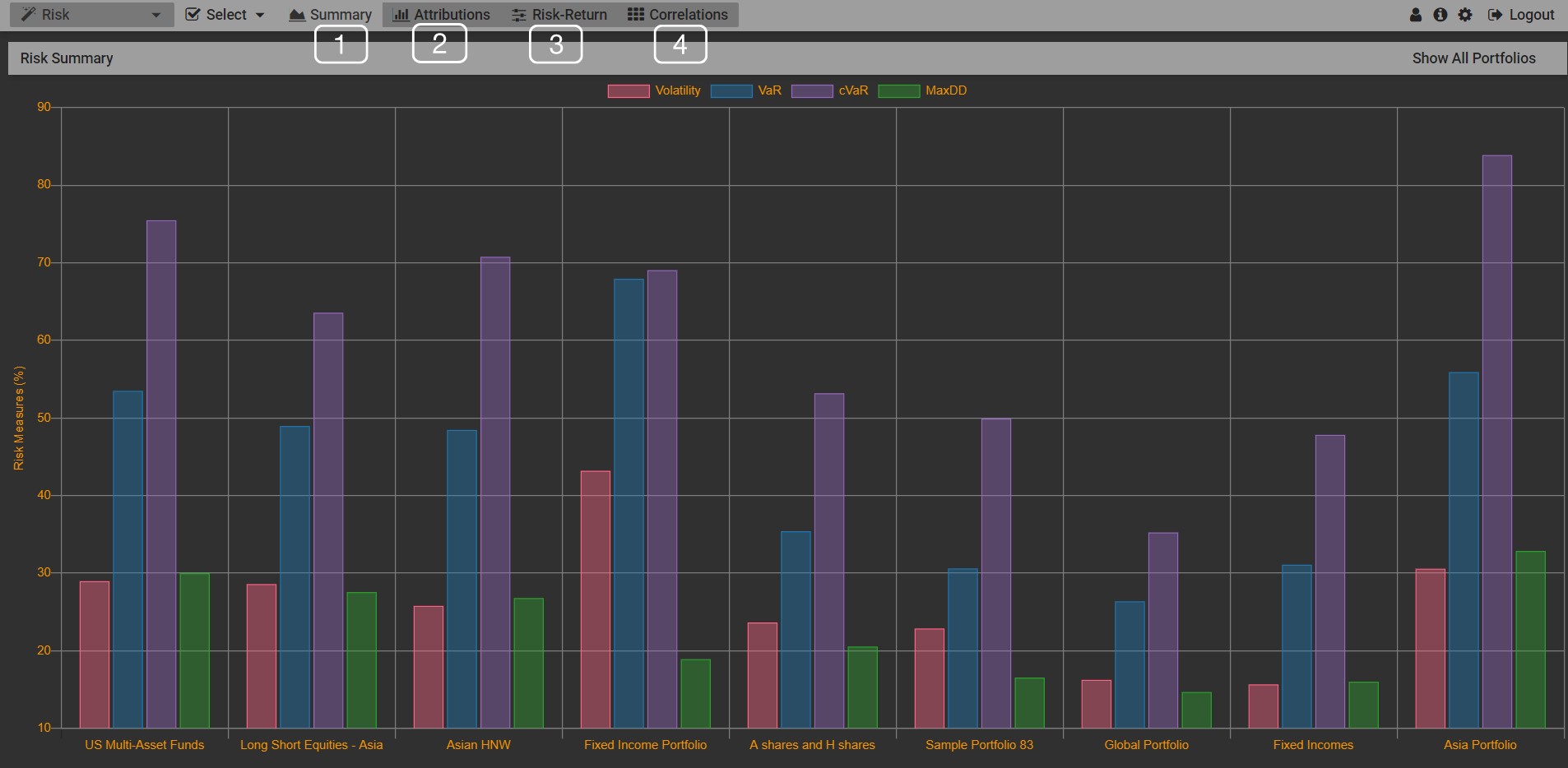

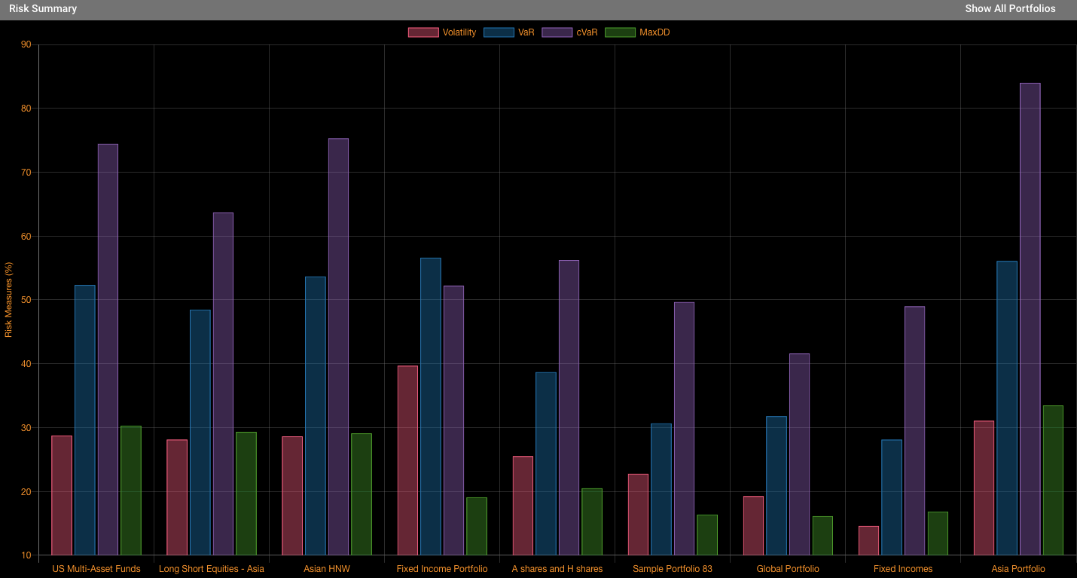

Risk Summary

You can review the risk measure (%) chart

in this platform.

Every portfolio has four bars which

represent following information:

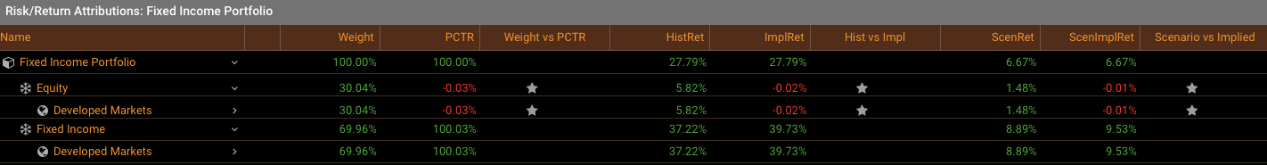

Risk/ Return Attribution

You can view the risk/return attribution

of every equity as Investor Porter.

This tab offers following information:

Risk-Return

This tab plots the comparison between your

selected portfolio and the efficiency frontier.

You can change and select

different portfolio/model portfolio to conduct the comparison with the

efficiency frontier in the group of the Expected Return (%) vs Volatility.

Correlation

Click Correlation and view correlation

between assets in your selected portfolio.